does idaho have inheritance tax

Inheritance laws from other states may apply to you though if a person who lived in a state with an inheritance tax leaves something to you. However like all other states it has its own inheritance laws including the ones that cover what.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Idaho does not levy an inheritance tax or an estate tax.

. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Also like Utah Idaho levies no inheritance or estate taxes. It operates almost like an inheritance tax on the heirs but it is much more severe and it is levied through the INCOME TAX SYSTEM.

You will also likely have to file some taxes on behalf of the deceased. Idaho Inheritance and Gift Tax. Idaho has no state inheritance or estate tax.

Idaho residents do not need to worry about a state estate or inheritance tax. You will also likely have to file some taxes on behalf of the deceased. Idaho also does not have an inheritance tax.

All Major Categories Covered. You must complete Form CG to compute your Idaho capital gains deduction. Even though Idaho does not collect an inheritance tax however you could end up paying.

The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012. Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022. Get Your Taxes Done Right With Support From An Experienced TurboTax Tax Expert Online.

Keep in mind that if you inherit property from another state that state may have an estate tax that applies. 1 2005 contact us in the Boise area at 208 334-7660 or toll free at 800 972-7660. Idaho does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax.

Select Popular Legal Forms Packages of Any Category. Since this state doesnt collect its own inheritance tax you likely wont have to pay anything. Overall Idaho tax structure.

The US does not impose an inheritance tax but it does impose a gift tax. That places it No. For more details on Idaho estate tax requirements for deaths before Jan.

However if the person whom youve inherited money possessions or property from lives in a state that does collect an. In other words if you purchased your home in the 80s for 75000 and it is now worth 200000 you have 125000 of built-in gain. Ad TurboTax Tax Experts Are On Demand To Help.

However like all other states it has its own inheritance laws including the ones that cover what. It does not tax Social Security but it does tax retirement accounts including 401ks. No estate tax or inheritance tax.

36 in the nation. And if your estate is large enough it may be subject to the federal estate tax. The top estate tax rate is 16 percent exemption threshold.

WalletHub says Idahos overall tax burden is relatively low too 788. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Even though Idaho does not collect an inheritance tax however you could end up paying.

1 2005 contact us in the Boise area at 208 334-7660 or toll free at 800 972-7660. From Fisher Investments 40 years managing money and helping thousands of families. In Kentucky for instance the inheritance tax applies to all in-state property even for out-of-state inheritors.

Idaho has no state inheritance or estate tax. Also gifts of 15000 and below do not require any tax payment or estate tax return. Alabama Alaska Arizona Arkansas California Colorado Delaware Florida Georgia Hawaii Idaho Indiana Kansas Louisiana Michigan Mississippi Missouri Montana Nevada New Hampshire New Mexico North Carolina North Dakota Ohio Oklahoma South Carolina South Dakota.

Page last updated May 21 2019. Idaho does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax. Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property.

Idaho does not levy an inheritance tax or an estate tax. Idaho has no gift tax or inheritance tax and its estate tax expired in 2004. Idaho residents do not need to worry about a state estate or inheritance tax.

Idaho is considered a tax friendly state. No estate tax or inheritance tax Illinois. Keep in mind that if you inherit property from another state that state may have an estate tax that applies.

100 Accurate Expert Approved Guarantee. Idaho has no gift tax or inheritance tax and its estate tax expired in 2004. Last full review of page.

For tax year 2001 only the deduction was increased to 80 of the qualifying capital gain net income. For more details on Idaho estate tax requirements for deaths before Jan. For those of you who live in Idaho there are several factors that will need to be taken into account to determine how much you would be required to pay.

Idahos capital gains deduction. The potential INCOME tax rate on that built in gain even if all of it is classified as a capital gain is 26 20 federal. As a result there are 32 states that dont collect death-related taxes.

Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013. The gift tax exemption mirrors the estate tax exemption.

What Is Probate Real Estate Here S A Breakdown Of The Probate Process

Idaho Health Legal And End Of Life Resources Everplans

Idaho Estate Tax Everything You Need To Know Smartasset

Double Death Tax The Wrong Way To Go Opinion Argusobserver Com

Historical Idaho Tax Policy Information Ballotpedia

States With Highest And Lowest Sales Tax Rates

Free Idaho Online Tax Records The Ancestor Hunt

4 Things You Need To Know About Inheritance And Estate Taxes

Idaho Estate Tax Everything You Need To Know Smartasset

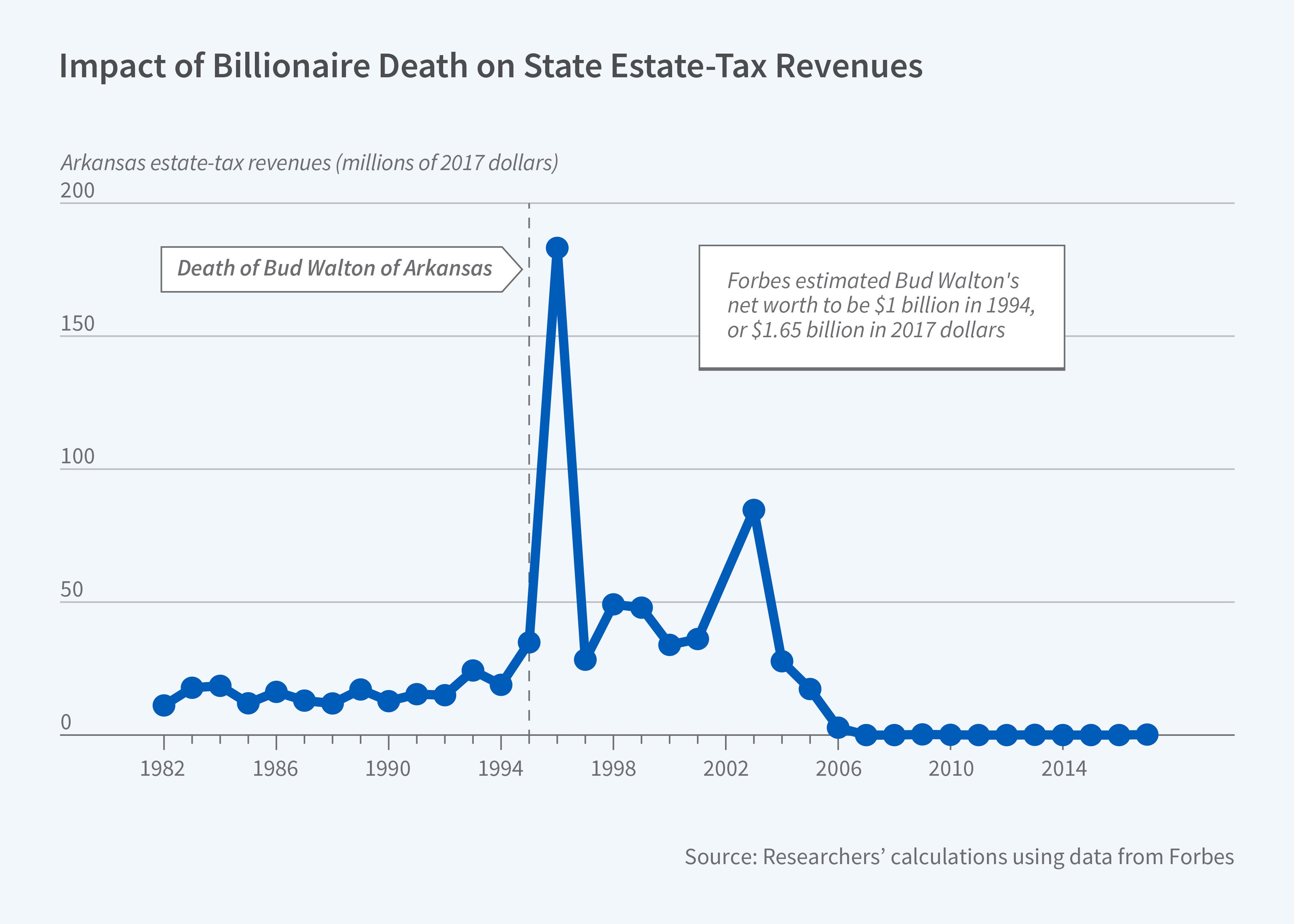

State Level Estate Taxes Spur Some Billionaires To Move Nber

Here S Which States Collect Zero Estate Or Inheritance Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Idaho Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Is Tax Liability Calculated Common Tax Questions Answered

States With An Inheritance Tax Recently Updated For 2020

State Estate And Inheritance Taxes Itep